Tulsa, Ok Bankruptcy Attorney: Understanding Bankruptcy And Alimony Payments

Table of ContentsTulsa Bankruptcy Lawyer: Ensuring Your Case Is Handled ProperlyTulsa Bankruptcy Lawyer: The Most Common Types Of CasesBankruptcy Lawyer Tulsa: The Connection Between Bankruptcy And Consumer ProtectionTulsa, Ok Bankruptcy Attorney: Understanding Bankruptcy And Alimony Payments

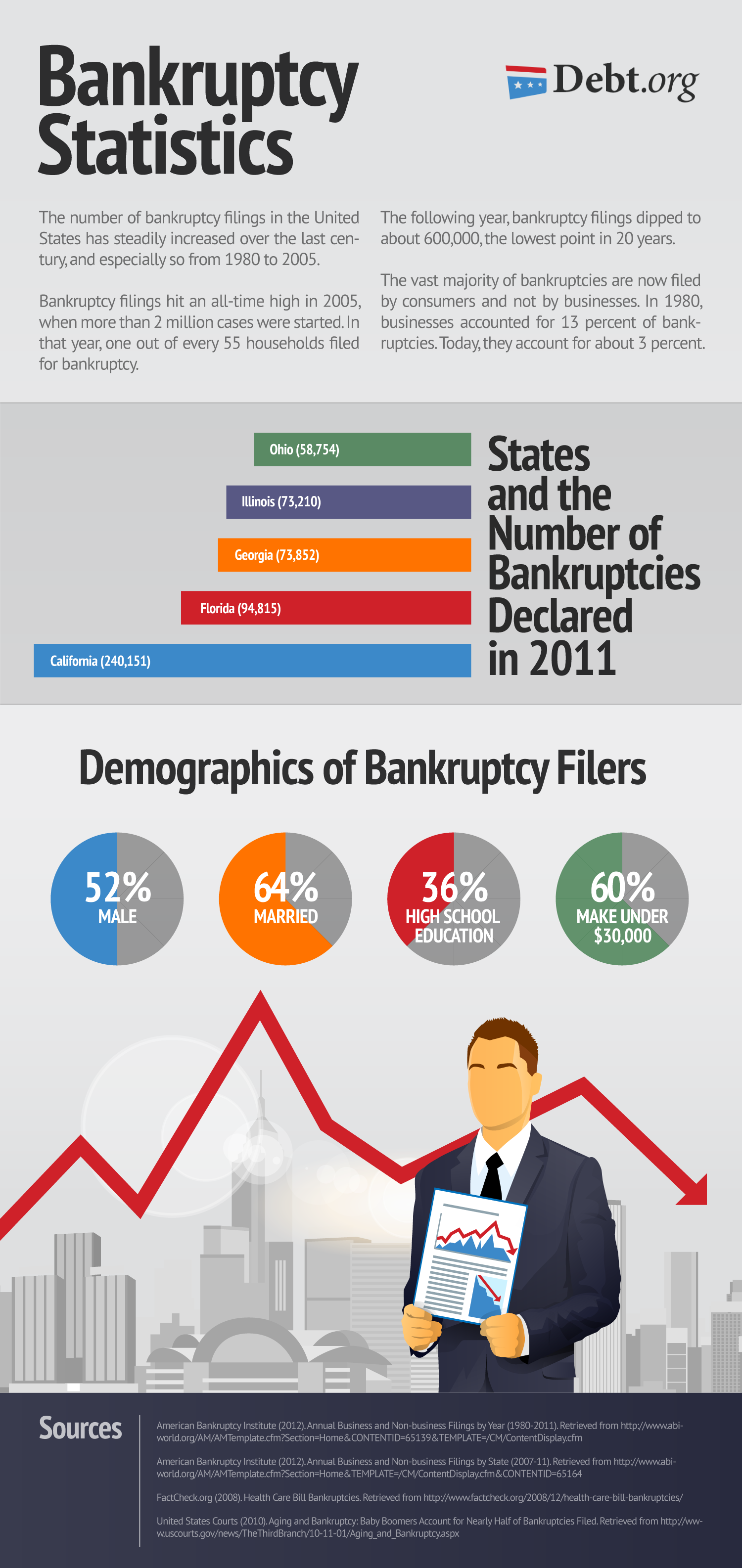

It can damage your credit for anywhere from 7-10 years and also be a challenge towards getting security clearances. Nonetheless, if you can't settle your troubles in much less than five years, bankruptcy is a sensible option. Attorney costs for bankruptcy vary depending upon which form you select, just how complicated your situation is as well as where you are geographically. bankruptcy lawyer Tulsa.Various other personal bankruptcy expenses include a declaring fee ($338 for Chapter 7; $313 for Phase 13); as well as charges for credit history therapy and monetary administration training courses, which both cost from $10 to $100.

You don't always require an attorney when submitting private bankruptcy by yourself or "pro se," the term for representing on your own. If the instance is straightforward enough, you can apply for personal bankruptcy without aid. But most individuals take advantage of representation. This post clarifies: when Chapter 7 is as well complicated to handle on your own why employing a Chapter 13 lawyer is always crucial, as well as if you represent on your own, just how a personal bankruptcy application preparer can aid.

, the order getting rid of financial debt. Plan on filling up out substantial documentation, gathering monetary paperwork, researching personal bankruptcy as well as exception legislations, and also adhering to local guidelines and also procedures.

Bankruptcy Lawyer Tulsa: The Challenges Of Filing Bankruptcy Without Legal Help

Right here are two situations that constantly require depiction. If you have a small company or have revenue over the mean degree of your state, a substantial quantity of properties, concern financial obligations, nondischargeable financial debts, or financial institutions that can make cases against you based on fraudulence, you'll likely want a legal representative.

Filers don't have an automatic right to dismiss a Chapter 7 instance. If you slip up, the bankruptcy court might toss out your case or offer assets you thought you can maintain. You can also deal with a bankruptcy suit to identify whether a financial debt should not be discharged. If you lose, you'll be stuck paying the financial obligation after insolvency.

Filers don't have an automatic right to dismiss a Chapter 7 instance. If you slip up, the bankruptcy court might toss out your case or offer assets you thought you can maintain. You can also deal with a bankruptcy suit to identify whether a financial debt should not be discharged. If you lose, you'll be stuck paying the financial obligation after insolvency. You might wish to submit Chapter 13 to catch up on mortgage financial obligations so you can keep your residence. Or you could desire to remove your 2nd home mortgage, "cram down" or minimize an auto loan, or repay a debt that will not vanish in bankruptcy in time, such as back tax obligations or assistance defaults.

You might wish to submit Chapter 13 to catch up on mortgage financial obligations so you can keep your residence. Or you could desire to remove your 2nd home mortgage, "cram down" or minimize an auto loan, or repay a debt that will not vanish in bankruptcy in time, such as back tax obligations or assistance defaults.In several situations, a bankruptcy legal representative can swiftly identify issues you might not find. Some people data for bankruptcy since they do not understand their alternatives.

Tulsa Bankruptcy Lawyer: How They Can Assist You Through Financial Struggles

For the majority of customers, the logical choices are Phase 7 and also Phase 13 personal bankruptcy. Tulsa bankruptcy attorney. Chapter 7 could be the way to go if you have reduced revenue as well as no properties.

Right here are typical issues personal bankruptcy lawyers can prevent. Bankruptcy is form-driven. Lots of self-represented personal bankruptcy borrowers do not file all of the called for bankruptcy files, as well as their situation gets disregarded.

If you stand to lose valuable residential or commercial property like your residence, vehicle, or various other home you care Tulsa bankruptcy attorney around, an attorney may be well worth the cash.

Not all insolvency instances proceed smoothly, as well as other, extra complicated concerns can occur. Lots of self-represented filers: do not recognize the significance of activities as well as adversary activities can't adequately defend against an activity seeking to deny discharge, as well as have a tough time conforming with complicated personal bankruptcy treatments.

When To Consider A Tulsa Bankruptcy Attorney For Your Financial Situation

Or something else may emerge. The lower line is that a lawyer is necessary when you discover yourself on the obtaining end of an activity or legal action. If you make a decision to submit for personal bankruptcy on your very own, discover what visit homepage solutions are available in your area for pro se filers.

Others can link you with legal help organizations that do the very same. Several courts and also their websites have info for consumers submitting for bankruptcy, from pamphlets describing low-priced or complimentary services to comprehensive info regarding insolvency. Getting a good self-help book is additionally an outstanding idea. Search for an insolvency book that highlights scenarios calling for a lawyer.

You need to accurately submit numerous forms, research study the law, and go to hearings. If you recognize personal bankruptcy law but would like assistance finishing the kinds (the standard personal bankruptcy petition is around 50 pages long), you might think about working with a bankruptcy petition preparer. A bankruptcy petition preparer is anyone or company, besides a lawyer or someone that works for an attorney, that charges a fee to prepare bankruptcy files.

Due to the fact that insolvency petition preparers are not attorneys, they can't offer legal suggestions or represent you in bankruptcy court. Specifically, they can not: inform you which sort of personal bankruptcy to file inform you not to provide specific financial debts tell you not to note particular assets, or inform you what residential or commercial property to exempt.

Due to the fact that insolvency petition preparers are not attorneys, they can't offer legal suggestions or represent you in bankruptcy court. Specifically, they can not: inform you which sort of personal bankruptcy to file inform you not to provide specific financial debts tell you not to note particular assets, or inform you what residential or commercial property to exempt.